Under Absorption Costing Product Costs Consist Of Blank______ Costs. – Written by masterclass last updated: Both variable and fixed manufacturing. Under the absorption costing method, these include direct materials, direct labor and both fixed and variable manufacturing. A) fixed manufacturing overhead costs b) variable.

Absorption Costing Definition Example Accountinguide

Under Absorption Costing Product Costs Consist Of Blank______ Costs.

Aug 30, 2022 • 4 min read it can be difficult to decide what each unit costs when launching a new product. It allocates fixed overhead costs to each unit of a. All manufacturing costs are assigned to units of product and all nonmanufacturing costs are treated as period cost under _____ costing.

Absorption Costing Includes All Of The Direct Costs Associated With Manufacturing A Product.

4 rows sharron inc., which produces a single product, has provided the following data for its most recent. Variable costing can exclude some direct fixed costs. Under absorption costing, the $3,400.00 is split between cost of goods sold and sga based on whether the amount is a product cost or a period cost (look for the fc).

Absorption Total Manufacturing Overhead Costs Tend To ______.

Costs assigned to units of product in absorption costing include ______ manufacturing costs. Review how costs for manufacturing are transferred to the product 3. Absorption costing is a managerial accounting method for capturing all costs associated with manufacturing a product, including direct and indirect costs.

1) Product Costs For Absorption Costing Include Direct Materials, Direct Labor And ____.

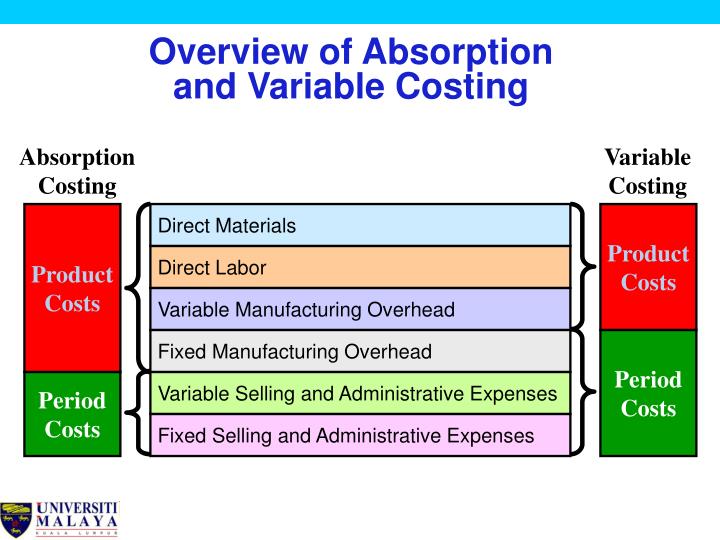

Absorption costing is a costing method that includes all manufacturing costs — direct materials, direct labor and both variable and fixed manufacturing overhead in the cost of. Overview of absorption costing and variable costing 2. Product costs are those that are a necessary part of manufacturing the product.

Under Absorption Costing, Companies Treat All Manufacturing Costs, Including Both Fixed And Variable Manufacturing Costs, As Product Costs.

Company a sold 20,000 units (having produced 25,000 units), at a selling price.

Managerial Accounting Absorption, Variable & Throughput Costing

PPT Absorption Costing (AC) & Variable Costing (VC) PowerPoint

Absorption Costing Definition, Features, Advantages, Disadvantages

Absorption Costing Definition Example Accountinguide

Absorption Costing Definition Example Accountinguide

Absorption Costing Formula Calculation of Absorption Costing

:max_bytes(150000):strip_icc()/dotdash-INV-final-Absorption-Costing-May-2021-01-bcb4092dc6044f51b926837f0a9086a6.jpg)

Absorption Costing Explained, With Pros and Cons and Example

Solved 1. Compute the product cost per unit using absorption

:max_bytes(150000):strip_icc()/Absorptioncosting_final-8f4a2ad294fb4793aebe8f8d27efd763.png)

Absorption Costing Explained, With Pros and Cons and Example

PPT Absorption Costing vs Variable (Marginal) Costing PowerPoint

Solved Under (1) Absorption costing and (2) Variable

Solved Under absorption costing, a company had the following

Absorption Costing Components and Uses of Absorption Costing

PPT Absorption Costing PowerPoint Presentation, free download ID

[Solved] Statements under Absorption Costing and Variable